Book Review: The (Mis)behavior of Markets

[books finance fractal Some notes on Benoit Mandelbrot & Richard Hudson, The (Mis)behavior of Markets: A Fractal View of Financial Turbulence (2004). Premise: The (geometric) Brownian motion model of asset prices, and the house built upon its Gaussian foundation (i.e., Bachelier, Markowitz efficient portfolios, Sharpe’s Capital Asset Pricing Model, Black-Scholes) fails to capture the extreme variations present in real-data. Power law distributions, fractional Brownian motion (which has postive or negative time-correlations) and multi-fractal regime changes better capture observed variations…

Notes

- pp. 20+ Five rules

- Markets are risky

- Trouble runs in streaks

- Markets have a personality

- Markest mislead

- Market time is relative

- p. 184: corrolograms of tree-ring data

- p. 191: estimate H for different asset types (Taqqui)

- p. 208: Two types of variability: Noah (big changes can happen, governed by power law, with parameter \alpha) & Joseph (persistent motion/time correlations: described by fractional brownian motion with parameter H)

- p. 208: multifractal model

- pp. 227+ Ten Heresies of Finance

- Markets are turbulent

- Markets are very, very risky—more risky than the standard theories imagine

- Market timing matters greatly. Big gains and losses concentrate into small packages of time.

- Prices often leap, not glide. That adds to risk

- In markets, time is flexible

- Markets in all places and ages work alike

- Markets are inherently uncertain, and bubbles are inevitable

- Markets are deceptive

- Forecasting prices may be perilous, but you can estimate the odds of future volatility

- In financial markets, the idea of ‘Value’ has limited value

- p. 253: Richard Olsen and Oanda.com

- p. 259 Jean-Phillipe Bouchaud: multifractal/mean reversion + tail chiseeling by incorporating long tail hypothesis to avoid catastrophic risk

- p. 263 fractal fingerprint

Some Mathematica fiddlings

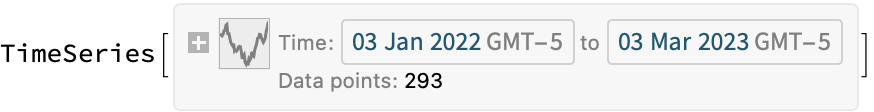

Pull stock prices and plot daily differences and see how it differs from the Browninan walk model but looks like a long tail distribution:

daily = FinancialData["NASDAQ:GOOG", {2022, 01, 01}]

With[

{diff = Differences@daily["Values"]},

{ListPlot[diff, Filling -> Axis], Histogram[diff]}] // GraphicsRow

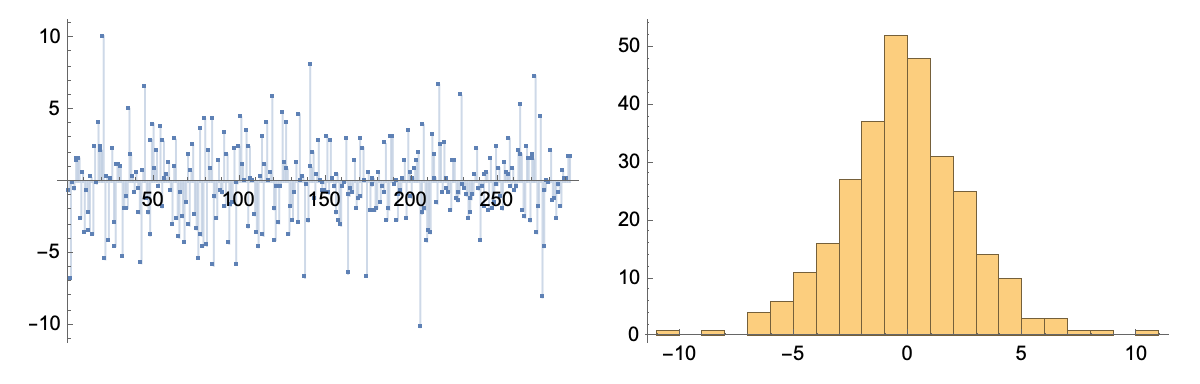

proc = EstimatedProcess[daily["Values"], GeometricBrownianMotionProcess[\[Mu], \[Sigma], S]]

path = RandomFunction[proc, {1, 293, 1}]

With[

{diff = Differences@path["Values"]},

{ListPlot[diff, Filling -> Axis], Histogram[diff]}] // GraphicsRow

(*GeometricBrownianMotionProcess[-0.00117877, 0.0247642, 145.074]*)

I don’t know…looks like the Geometric Brownian motion is a pretty good description over this time period…

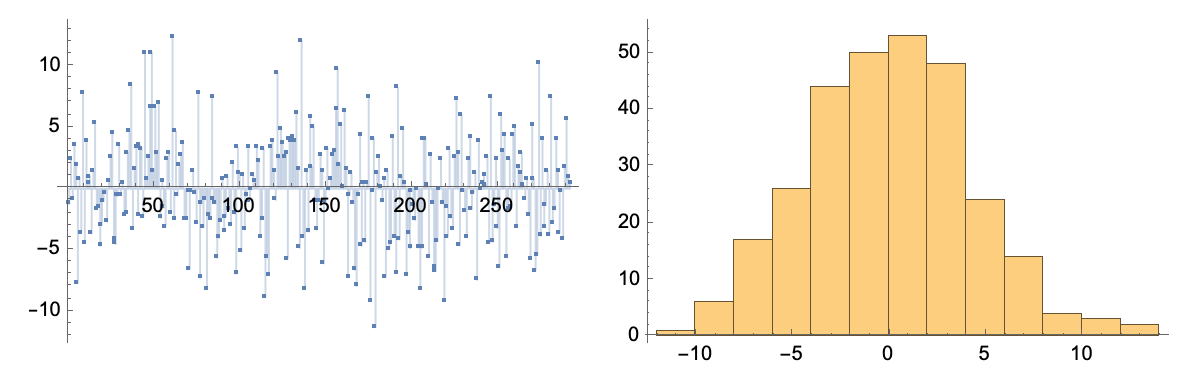

Reproduce figure with fraction brownian walk. H = 0.1, H=0.5, H=0.9

{low, med, high} = FractionalBrownianMotionProcess[0, 1, #] & /@ {0.1, 0.5, 0.9};

GraphicsRow@Map[ListLinePlot@RandomFunction[#, {1, 252, 1}, 3] &]@{low, med, high}

Further reading and resources / bibliographic extracts

- Mandelbrot’s website

- Fractals and Scaling in Finance (1997)

- Gaussian Self-Affinity and Fractals (2002)

- Bouchaud, A First Course in Random Matrix Theory (2020)

- Bouchaud Theory of Financial Risk (2003)

- Bouchaud An Introduction to Statistical Finance Physica A (2002)

- Would love to get some notes from Fischer Black’s “50 questions in finance” course.

- https://www.oanda.com forex exchange

- Knauf Making Money from FX Volatility Quant Finance (2003)

- Mandelbrot’s student, Calvet, has published a book on Multifractal Volatility: Theory, Forecasting and Pricing (2008) which seems pretty interesting